All major market segments experienced seasonally adjusted prices that were down year over year in September, although declines in recent months have slowed.

Wholesale used-vehicle prices (on a mix, mileage, and seasonally adjusted basis) were lower in September than in August and July, marking a negative turn toward continued but mild wholesale depreciation.

The Manheim Used Vehicle Value Index (MUVVI) fell to 203, a decline of 5.3% from a year ago, according to figures released Oct. 7. The index’s seasonal adjustment amplified the change for the month, as non-seasonally adjusted values fell slightly. The non-adjusted price in September decreased by 0.1% compared to August, moving the unadjusted average price down 4.9% year over year.

“Wholesale values reversed course and turned negative over the month of September after rising in July and August,” said Jeremy Robb, senior director of economic and industry insights at Cox Automotive, in a news release. “Non-adjusted prices usually decline in September, and while that occurred this year, prices fell less than they normally do for the month. Retail used days’ supply remains lower than in the last few years, and off-lease maturities will continue to decline. The new normal will likely continue to see wholesale depreciation, but it may be more muted than the market is accustomed to for the rest of the year.”

In September, Manheim Market Report (MMR) values saw weekly decreases in every week of the month. Over the last four weeks, the Three-Year-Old Index decreased by an aggregate of 1.6%, with a larger decline of 0.7% in the month’s final week. Between 2014 and 2019, those same four weeks delivered an average decrease of 1.8%, indicating depreciation trends were less than typically seen this time of year, even with a larger decline in the final week.

During September, daily MMR Retention, the average difference in price relative to the current MMR, averaged 98.5%, meaning market prices stayed below MMR values again this month and moved further away from market valuations versus August levels. Compared to last month, valuation models moved down four-tenths of a point on MMR retention, as it is normal for this metric to move lower as wholesale values decline.

The average daily sales conversion rate in September fell to 60.3%, a decline of a little more than 2 points from last month yet higher than usual at this time of year. For comparison, the daily sales conversion rate averaged 53.0% in September over the previous three years.

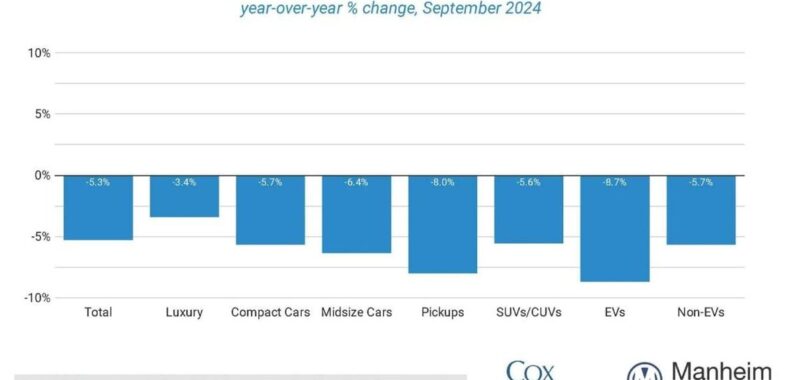

All major market segments experienced seasonally adjusted prices that were down year over year in September, although declines in recent months have slowed.

- Compared to September 2023, luxury was the only segment to outperform the market as it was lower by only 3.4%.

- Performing worse than the overall industry, SUVs were down 5.6%

- Compact cars fell 5.7%

- Midsize sedans declined 6.4%

- Pickups fell the most, showing a decline of 8% year over year

Compared to August, compact cars were the only segment to show a gain, rising by 1.2%, while SUVs were down just 0.3% month over month, lower than the industry average. Pickups were a bit worse than the industry, declining by 0.6%, with the luxury segment lower by 1% and midsize sedans falling by 1.2% month over month.

Looking at the market by powertrain, both electric vehicles (EVs) and non-EVs were lower compared to August. Seasonally adjusted EV values for September 2024 were down 8.7%, while non-EVs were down 5.7% year over year, continuing to show the trend that EVs have fallen more in value than the traditional powertrain segment. Looking at the change against August, seasonally adjusted EV values decreased more than the overall market, falling by 1.0% from August 2024, while non-EVs declined less, down by 0.7% over the same period.

Retail Used-Vehicle Sales Decreased in September

Assessing retail vehicle sales based on observed changes in units tracked by vAuto, initial estimates of retail used-vehicle sales in September were down 14% compared to August but higher year over year by 9%. The average retail listing price for a used vehicle decreased 0.7% over the last four weeks.

Using estimates of retail used days’ supply based on vAuto data, an initial assessment indicates September ended at 44 days’ supply, up six days from 38 days at the end of August and down six days from September 2023 at 50 days.

New-vehicle sales in September were down 12.8% from last year, and volume decreased 17.9% from August, due mostly to fewer sales days than last month and last year. The September sales pace, or seasonally adjusted annual rate (SAAR), came in at 15.8 million, up 0.1 million from last year’s pace and higher than August’s 15.3 million level.

Combined sales into large rental, commercial, and government fleets decreased 6.4% year over year in September. Including an estimate for fleet deliveries into dealer and manufacturer channels, the remaining new retail sales were estimated to be down 12.2% from last year, leading to an estimated retail SAAR of 12.4 million, down 0.9 million from last year’s pace, and down from August’s estimated 12.7 million level. Fleet share was estimated to be 14.9%, down from last year’s 15.4% share.

Rental Risk Prices and Mileage Were Mixed in September Against Last Year

The average price for rental risk units sold at auction in September declined 4.6% year over year. Rental risk prices decreased by 0.1% compared to August. Average mileage for rental risk units in September (at 52,600 miles) rose 4.8% year over year and was down 3.8% from August 2024.

Measures of Consumer Confidence Were Mixed in September

The Conference Board Consumer Confidence Index declined 6.5% in September, when an increase had been expected; but August’s index was revised higher. Consumers’ views of the present and the future declined. Consumer confidence was down 5.4% year over year. Plans to purchase a vehicle in the next six months increased slightly compared to August but were down slightly year over year.

According to the sentiment index from the University of Michigan, consumer sentiment increased 3.2% in September compared to August and was up 3.2% year over year. The median consumer expectation for inflation in a year declined to 2.7%, the lowest level since December 2020. The expectation for inflation in five years increased to 3.1%. Consumers’ view of vehicle buying conditions has improved to the best level since April.

The daily consumer sentiment index from Morning Consult increased 1.4% in September, extending a streak of four monthly gains and up 8.6% year over year. Gas prices declined again in September. According to AAA, the national average price for unleaded gas was $3.20 per gallon as of Sept. 30, down 3.9% from the end of August and down 16% year over year.