Considering the strong Q4, full-year 2024 U.S. auto sales are expected to reach about 15.85 million units, reflecting a 2.3% increase from 15.55 million in 2023.

December new-vehicle sales, to be confirmed in early January, are expected to show steady growth over last year’s market, according to a Cox Automotive forecast released Dec. 17.

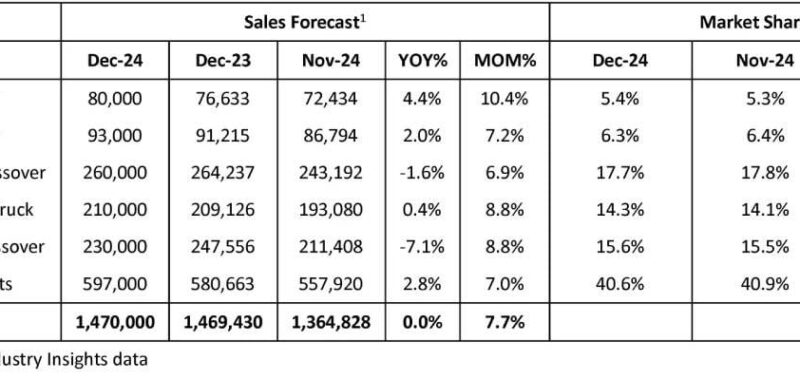

December’s seasonally adjusted annual rate (SAAR), or sales pace, is expected to finish at 16.5 million. This SAAR is up from last year’s 15.9 million level and equal to November’s 16.5 million. Sales volume in December is expected to reach 1.47 million, a 7.7% increase from last month but flat compared to one year ago.

“With the U.S. election season now in the rearview mirror, we are seeing a bit of a bump up in sales,” said Charlie Chesbrough, senior economist at Cox Automotive, in a Dec. 17 news release. “Both October and November saw a shift to a higher sales pace, and a similar outcome is forecast this month. Many buyers who thought it best to wait for the best deal realize that now is the time to buy before [possible] new administration policy changes. Some vehicle buyers are taking advantage of EV discounts that the new administration could dial back; others may be concerned that potential tariffs may hit prices. So, the market has strong tailwinds as the year ends.”

Robust Q4 Performance Drives 2024 Auto Sales Above Forecasts

New vehicle sales remained steady through the first three quarters of 2024, supported by improved inventory and higher incentives. However, since October, the sales pace has shifted to a higher gear, with the fourth quarter expected to finish with a SAAR of 16.4 million.

Considering the strong Q4, full-year 2024 U.S. auto sales, as estimated by Kelley Blue Book, are expected to reach about 15.85 million units, reflecting a 2.3% increase from 15.55 million in 2023 and slightly above Cox Automotive’s forecast of 15.7 million shared at the beginning of the year. Improving consumer confidence, lower interest rates, and less uncertainty are lifting Q4 sales, and that trend is expected to continue into next year. Cox Automotive expects new vehicle sales to improve further in 2025, reaching 16.3 million units.

All percentages are based on raw volume, not daily selling rate. There are 25 selling days this month, one less than November 2024 and one less than December 2023.

General Motors Retains Sales Crown in 2024, Honda Gains Most Share

Every major manufacturer delivered year-over-year sales gains in 2024 except Stellantis and Tesla, while BMW’s sales were flat. The 2024 sales crown will go to General Motors, with sales forecast to finish near 2.7 million units, up over 4.2% from last year.

If success is measured by higher market share, however, Honda will be the big winner in 2024, gaining half a point in share thanks to a more-than-20% sales increase from the HR-V and Civic, the two lowest-priced vehicles in its portfolio. In 2024, Honda Motor sales in the U.S. – combined Honda and Acura volume – outpaced Stellantis, jumping the storied Japanese brand into fifth place on the sales chart.

Forecast: 2025

As the auto market heads into 2025, the Cox Automotive economic and industry insights team anticipates the new vehicle market to grow by about 3%. Overall, the team expects 2025 to be another positive year for car buying.